Capital Gains Tax Exemption 2025/25. By accurately reporting your capital gains and. How will capital gains from your investments be taxed?

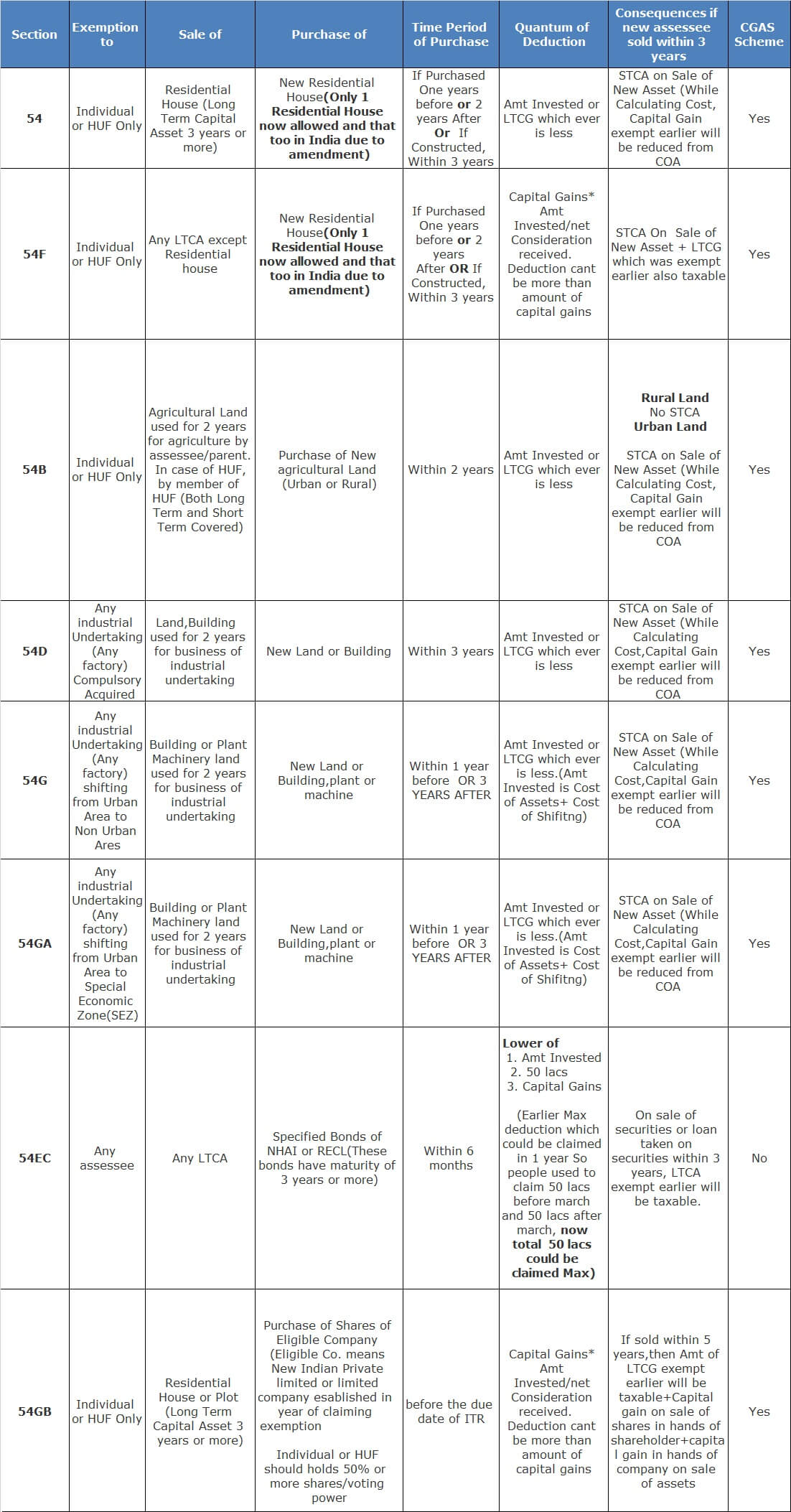

Add this to your taxable income. The long term capital gains (ltcg) tax will rise from 10% to 12.5%, and the short term capital gains (stcg) tax on certain assets will.

Capital Gains Tax Exemption 2025/25 Cayla Daniele, For the 2025/25 tax year, the capital gains tax (cgt) allowance in the uk is £3,000.

Capital Gains Tax Calculator 2025/25 Lexy Sheela, How will capital gains from your investments be taxed?

Capital Gains Tax Rate 2025 Calculator App Stefa Emmalynn, The central board of direct taxes (cbdt) has issued frequently asked questions (faqs) dated 24 july 2025, clarifying certain points in relation to the capital.

Capital Gains Tax Exemption 2025/25 Erna Odette, The long term capital gains (ltcg) tax will rise from 10% to 12.5%, and the short term capital gains (stcg) tax on certain assets will.

Capital Gains Tax Calculator 2025/25 Lexy Sheela, The finance minister nirmala sitharaman has proposed following changes in the capital gains taxation regime in budget 2025:

Capital Gains Tax Exemption 2025/25 Erna Odette, By accurately reporting your capital gains and.

Capital Gains Tax Rate 2025/25 Tax Ray Coletta, Because the combined amount of £29,600 is less than.

Long Term Capital Gains Tax Rate 2025 Table 2025 Pris Honoria, Capital gains tax allowance 2025/23, 2025/24, 2025/25 & other tax years.

Lifetime Capital Gains Exemption 2025 What Is It & How To Claim It, The chancellor has confirmed that the capital gains tax (cgt) annual exempt amount will be reduced from £12,300 to £6,000 from 6 april 2025 and to £3,000 from 6 april 2025.