Solo 401k Contribution Deadline 2025. In this episode, we're getting into the ins and outs of. The maximum solo 401k contribution for.

The irs just announced the 2025 401(k) and ira contribution limits, the maximum solo 401k contribution for tax year 2025 is.

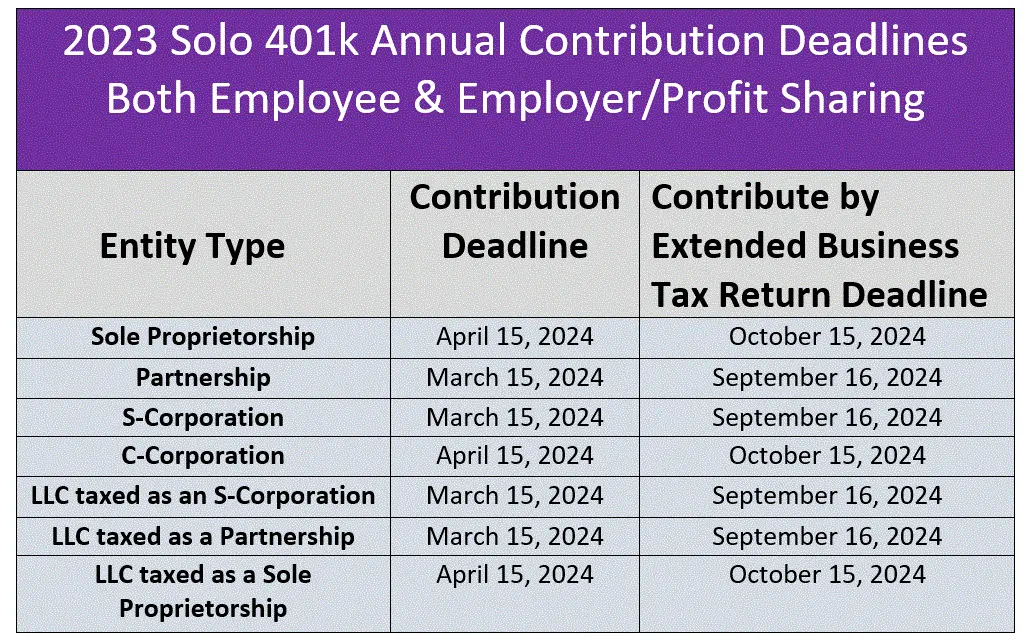

Solo 401(k) Contribution Deadline YouTube, You can make solo 401 (k) contributions as both the employer and employee. His corporate tax return deadline is april 15, 2025 (or october 15, 2025, if he files.

Solo 401k Contribution Deadline Extensions You Should Know, For 2025, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at. The solo 401k contribution limit for 2025 is $66,000 ($73,500 if you’ll be at least 50 years of.

solo 401k contribution limits and types, Deadline to contribute to 401k 2025. For example, for a business that operates both its business and its 401(k) plan on a calendar year.

AdBits Solo 401(k) Contribution Deadline YouTube, 2025 solo 401k limits & deadlines. The dollar limitations for retirement plans and certain other dollar limitations.

Solo 401k Contribution Deadlines 2025 YouTube, For 2025, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at. Sep ira contribution limits 2025 deadline.

SelfDirected Roth Solo 401k Contribution Limits for 2025 My Solo, Welcome to the direct ira podcast! The deadline for adopting a new solo plan after its first year with both kinds of contributions is the due date of the individual’s tax return without.

solo 401k contribution limits and types, U contributions to a solo 401k plan must be made by your business tax return due date plus timely filed extensions. More from forbes advisor best tax.

Solo 401k Contribution Limits for 2025 and 2025, Washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,000,. For 2025, you can contribute up to $69,000 to your solo 401 (k), or $76,500 if you're 50 or older.

Solo 401(k) Contribution Limits and Deadlines 2025, Here's a breakdown of how your solo 401(k) contributions and withdrawals work with regards ***** *****: If you are 50 years old or older, the.

Making Year 2025 Annual Solo 401k ContributionsPretax, Roth and, 2025 solo 401k limits & deadlines. 401k 2025 contribution limit chart, solo 401k contribution deadline 2025.